An IRS levy is a process in which the government seizes some property of delinquent taxpayers. Levies have a specific timeline of triggers and events leading up to the seizure. Some assets and income streams are exempt from a tax levy. Below, we discuss the timeline of a levy and the assets and income that a levy can affect. We describe resolving a tax levy in another article.

How does an IRS levy come about?

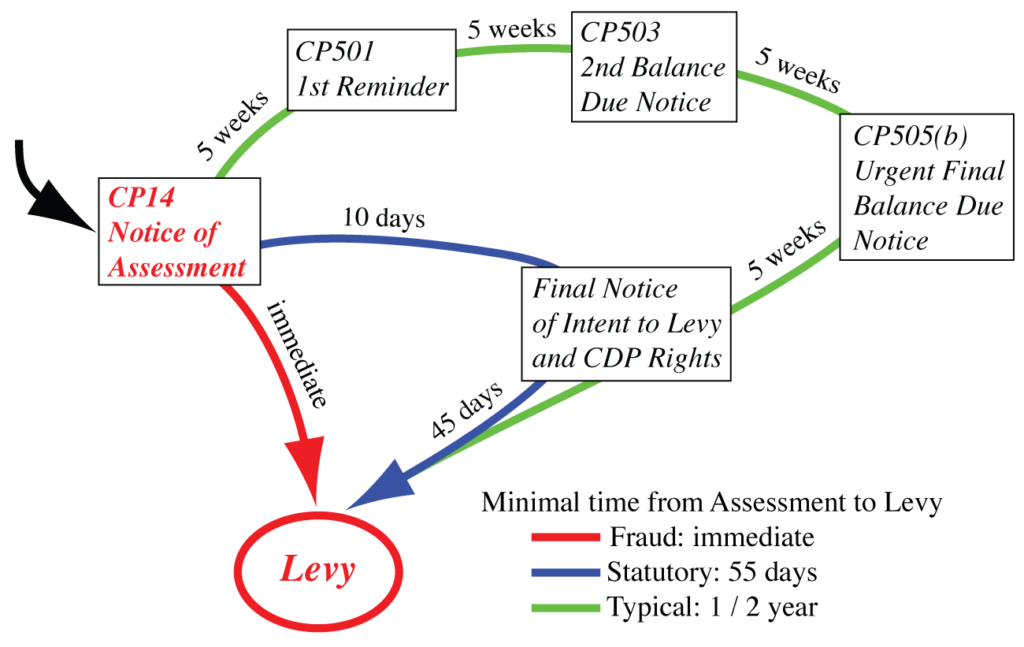

The three ingredients that trigger a tax levy are tax due, no or insufficient response from the taxpayer, and time. A serious attempt to resolve the tax debt is crucial for avoiding a levy. You typically have more than half a year before you can count on a levy. However, the time may be drastically shorter in some circumstances. Examples are if someone is involved in tax fraud, tries to hide assets from the IRS, keeps accumulating payroll tax due, or the IRS prepared several Substitutes for Return for years in which there was no filed return (IRM 5.11.1).

First phase: ASSESSMENT

The IRS assesses tax due under various circumstances, most commonly a filed tax return. Once the IRS sends a notice of assessment, you have ten days to pay. When the balance due is under $100k, the IRS may allow more time. After that, expect a series of three reminders in five-week intervals. If you ignore the IRS, the case will go to the Automated Collection System (ACS) or into a queue for a Revenue Officer.

Second phase: COLLECTIONS

Once your case is in collections, the IRS may send a Final Notice of Intent to Levy. They might send it right away or sometime later. With the Final Notice of Intent to Levy, you have 30 days to appeal and enter into an agreement with the IRS (IRM 5.11.1.3.2). After these 30 days, the IRS waits another 15 days (IRM 5.11.1.3.3.3). Then, a levy can occur at any time, affecting any of your income or assets.

How does the IRS decide whether to levy?

IRS Revenue Officers need to consider several factors before issuing a levy. The primary question is whether the levy will result in financial hardship (IRM 5.11.1.3.1). Then, levying is not allowed. Also, the IRS considers how cooperative you are. Are you responsive? Are you paying current taxes? Did you make an effort to pay the tax due? What is your tax compliance history? The more you cooperate, the less likely you will have a levy.

Other circumstances that may interfere with a levy are:

- The IRS has information that the taxpayer may not be at the last known address

- The case has been in the queue for collections for more than 12 months

The IRS also instructs Revenue Officers to exercise judgment when issuing repeated levies. Close spacing of levies could result in undue financial hardship (IRM 5.11.1.4.6).

Will the IRS notify you before they levy your bank account?

The IRS has to send only the Final Notice of Intent to Levy, notify you of your appeal rights, and wait 45 days. After that, you will receive levy notices only after the fact.

Can the IRS levy only bank accounts?

The IRS may levy most your assets. These include bank accounts, brokerage accounts, accounts receivable, retirement accounts, cars, real estate, cash deposited for bail, etc. Levies on income are sometimes called garnishments. These can affect wages, salary, social security benefits, rental income, etc.

Cash held by third parties is the preferred levy target. For seizing cash is cheaper than levying and auctioning physical assets. After all, the IRS is neither a realtor nor a pawnbroker and does not like to act like one.

The IRS prefers not to levy jointly owned property when it involves a person who does not owe tax. But they can seize joint property if there is no alternative source. The situation may become more complicated in community property states such as Texas. Spouses in Texas have a community property interest in each other’s earnings. Thus, the IRS may try to levy taxpayers by levying their non-liable spouse’s salary (IRM 5.11.6.13). Unfortunately, community property law complicates the levy process and makes it more prone to errors.

Are there assets that the IRS cannot levy?

Some property is exempt from levy. Here is a partial list (IRC 6334):

- Clothing and school books

- Fuel, food, and furniture up to $6,250 (adjusted for inflation since 1998)

- Books and tools of a trade, business, or profession up to $3,125 (adjusted for inflation since 1998)

- Unemployment benefits

- Undelivered mail

- Certain annuity and pension payments (Railroad, military Honor Roll, etc.)

- Worker’s compensation

- Child support payments

- Minimum exemption for wages, salaries, and other income

- Certain public assistance payments

- Principal residence, unless under jeopardy or otherwise approved

This list is short and contains mainly common-sense items. It is reassuring that the IRS cannot just seize your clothing, raid your fridge, drain your gas tank, or snatch away child support funds.

Note that your principal residence is protected. But in extreme circumstances, the IRS may seize even your house. Consent from an IRS (assistant) district director was sufficient until 1998. But now, approval from a district court of the US is needed.

What happens to my levied money?

The “source” of the levied funds needs to surrender your money instantly, with some exceptions (IRC 6332).

- Garnished wages/salaries are to be sent to the IRS on the date of your next paycheck.

- Banks will hold your money for 21 days before sending it to the IRS.

- Life insurance and endowment contract advances have a 90-day holding period.

Sometimes, people say that the IRS “froze” your bank account. But, the IRS merely instructed the bank to set aside the contents of your bank account for 21 days. After that time, the IRS will receive the funds. The levy affects your account on a specific date. You can continue using your bank account while the bank holds the funds. You may be able to negotiate a release of the levy within the 21 days. After the IRS receives the money, it is challenging to recover it.

A follow-up article discusses ways to deal with levies, including their release and recovery of funds. Contact us if you need help with an IRS levy.