Installment Agreements:

What can they do for you?

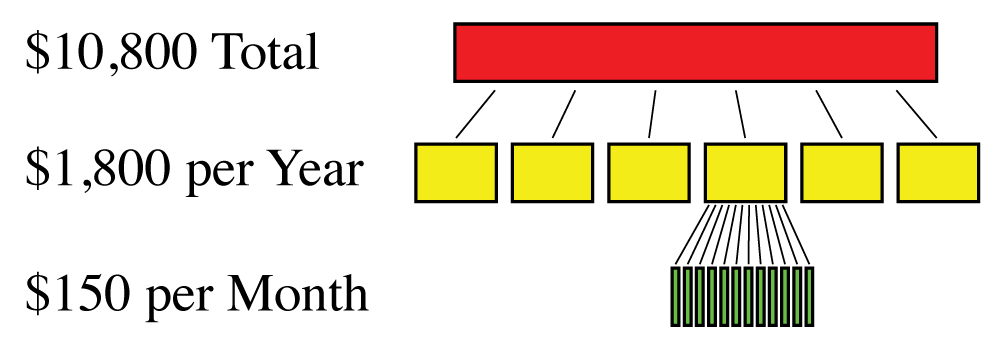

How Does the Installment Agreement Work?

If you have an amount due to the IRS, but cannot pay the full amount right away, you may arrange with the IRS smaller periodic payments. For example, you owe $10,800 and arrange to pay that amount within six years. That is $1,800 per year, or 72 monthly payments of $150 each.

Contact us if you need an installment agreement with the IRS!

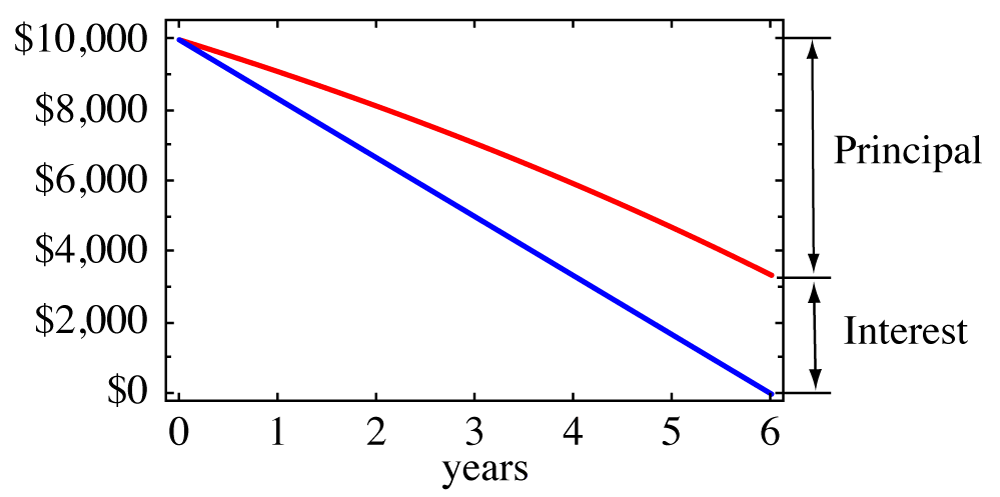

Match Your Ability to Pay With the Liability

The first benefit of an IA (Installment Agreement) is that you can break the tax liability into manageable pieces.

But you also need to consider that the IRS charges interest (see the current numbers here). After years of paying the minimal required amounts every month, thousands of dollars of interest may have accumulated. So, it is a good idea to pay additional amounts whenever feasible.

Flexibility of Payments

An Installment Agreement (IA) with the IRS will give you breathing room and time. This is particularly useful for taxpayers with irregular income streams. Setting up an IA with minimal payments will keep the IRS from launching into aggressive collection activity. Whenever a chunk of revenue comes in, a part of it can be designated as an additional payment to the IRS to pay down the balance more quickly and avoid paying additional interest and penalties.

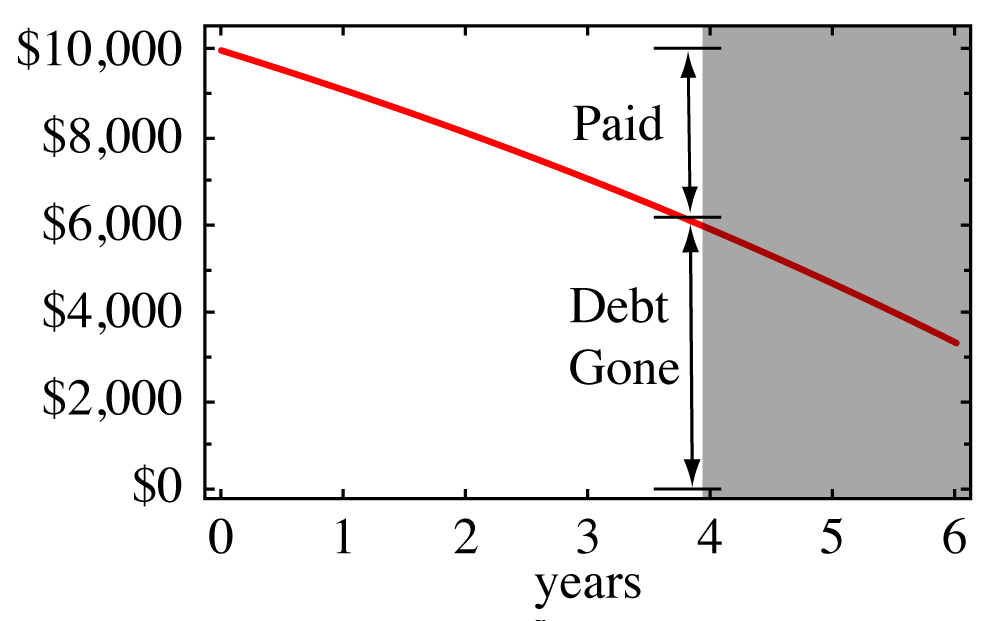

Potentially Reduce Your Amount Due

Sometimes the time the IRS has to collect your tax due runs out before the installment payments pay down the full amount. This is called a Partial Pay Installment Agreement, and – potentially – most of the debt won’t ever be collected. In the example graph, the grey area shows the portion of the installment agreement that extends beyond the limit of collection.

Installment Agreements Can Help Eliminate Notices of Tax Lien

Did the IRS record a tax lien against your house with your county? If you are in an Installment Agreement and paid the balance sufficiently down, you may be able to have the IRS withdraw the Notice of Federal Tax Lien.

Contact us if you want to get your tax liens out of the way!